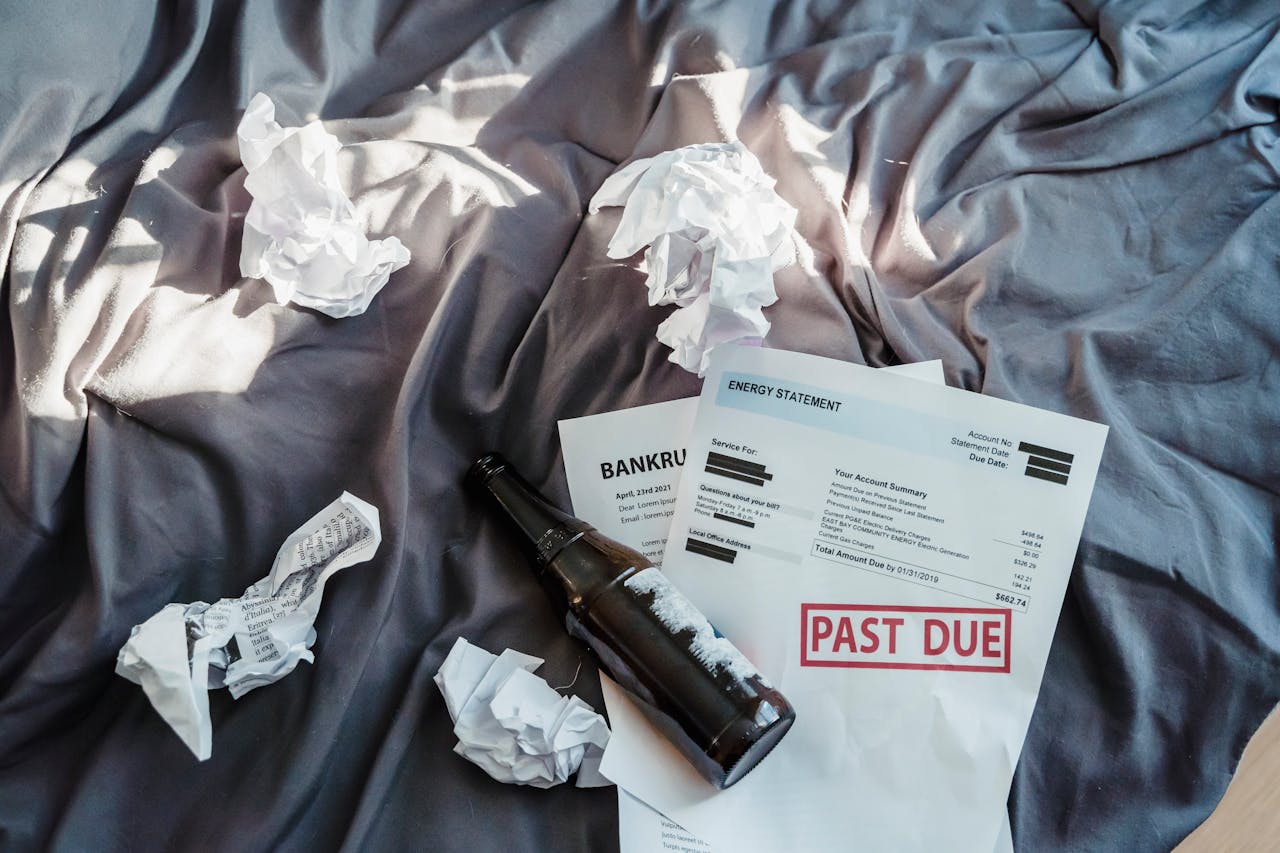

Creating a budget is one of the most effective ways to manage your finances and achieve your financial goals. However, even with the best intentions, certain budgeting mistakes can quietly drain your bank account, costing you thousands over time. Recognizing these pitfalls and learning how to avoid them can make all the difference in your financial well-being. Here are the most common budgeting mistakes that could be sabotaging your efforts and how to correct them.

1. Not Having a Budget at All

The biggest budgeting mistake is not having one in the first place. Without a plan for your money, it’s easy to overspend, accumulate debt, and miss out on savings opportunities. A budget helps you track income and expenses, ensuring you’re in control of your financial future.

2. Failing to Account for Irregular Expenses

Many people forget to include irregular or seasonal expenses, like holiday gifts, annual insurance premiums, or car maintenance, in their budget. These costs can catch you off guard and force you to dip into savings or rack up debt. Planning for these irregular expenses ensures you’re prepared when they arise.

3. Underestimating Your Spending

It’s easy to underestimate how much you spend on small purchases like coffee, snacks, or convenience items. These small expenses can add up quickly and blow your budget. Tracking every dollar you spend for a month can help you identify areas where you may be overspending.

4. Not Adjusting Your Budget Regularly

Life changes—whether it’s a new job, a pay raise, or increased bills—require adjustments to your budget. Sticking to an outdated budget can lead to overspending or missed savings opportunities. Regularly reviewing and updating your budget ensures it stays relevant to your current financial situation.

5. Relying on Credit Cards

Using credit cards to cover expenses not accounted for in your budget often leads to debt and high-interest payments. Relying on credit cards as a financial safety net is a costly mistake. Instead, build an emergency fund to cover unexpected expenses and avoid carrying a credit card balance.

6. Failing to Differentiate Between Wants and Needs

Confusing wants with needs can wreak havoc on your budget. While dining out or buying the latest gadgets may feel essential, these expenses are often discretionary. Prioritizing actual needs—like housing, groceries, and utilities—over wants ensures you’re living within your means.

7. Overlooking Savings

Many people make the mistake of treating savings as optional, only setting money aside if there’s anything left at the end of the month. This approach often leads to inconsistent or nonexistent savings. Treat your savings as a non-negotiable expense by automating contributions to a savings account.

8. Ignoring Debt Payments

Failing to prioritize debt repayment can cost you thousands in interest over time. While minimum payments keep you in good standing, they do little to reduce your balance. Allocate extra funds toward paying down high-interest debt as quickly as possible to save money in the long run.

9. Being Too Strict with Your Budget

A budget that’s too restrictive can feel suffocating, making it harder to stick to. This often leads to frustration and unplanned splurges. Allowing room for occasional treats or discretionary spending makes your budget more realistic and sustainable over time.

10. Not Tracking Expenses

Creating a budget is only half the battle—tracking your expenses is crucial to ensure you’re staying on track. Without monitoring your spending, it’s easy to lose sight of where your money is going. Use apps, spreadsheets, or even a notebook to track your expenses regularly.

11. Neglecting to Plan for Emergencies

An unexpected medical bill, car repair, or job loss can derail your finances if you’re unprepared. Failing to build an emergency fund leaves you vulnerable to debt and financial stress. Aim to save three to six months’ worth of living expenses in a dedicated emergency fund.

12. Setting Unrealistic Goals

Setting overly ambitious financial goals can lead to discouragement when you inevitably fall short. Unrealistic expectations often result in giving up on budgeting altogether. Instead, set achievable goals that motivate you and adjust them as your financial situation improves.

Budgeting is a powerful tool for managing your money, but avoiding common mistakes is just as important as creating the budget itself. By addressing these errors, you can gain better control over your finances, avoid unnecessary debt, and work toward your financial goals with confidence. A thoughtful, well-maintained budget doesn’t just save you money—it builds the foundation for long-term financial success.