Conventional financial advice is often touted as the ultimate path to wealth, but sticking rigidly to these rules might be holding you back. Building real wealth requires thinking outside the box, challenging norms, and tailoring strategies to your personal goals and circumstances. Here are the money rules you must break to truly grow your wealth and why stepping away from tradition can sometimes be the smartest move.

1. “Save Every Penny”

While saving is crucial, focusing solely on hoarding cash without investing it can stifle your financial growth. Inflation erodes the value of your money over time, meaning those savings in your bank account are losing purchasing power. Instead, prioritize investing your money in assets like stocks, real estate, or mutual funds to make it work for you and generate returns.

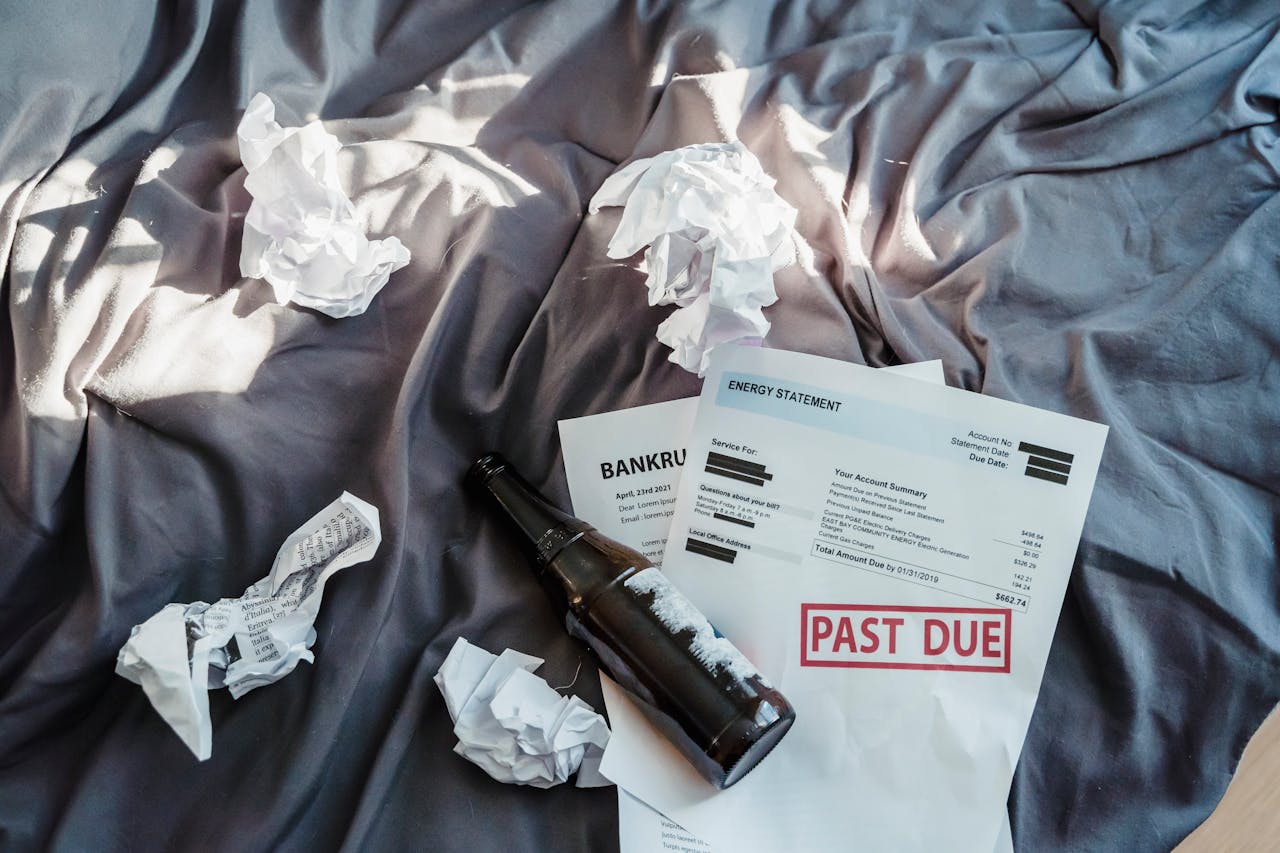

2. “Avoid All Debt”

Debt has a bad reputation, but not all debt is created equal. Avoiding debt entirely can limit your financial opportunities. Strategic use of “good debt,” such as mortgages or business loans, can help you acquire appreciating assets or invest in ventures that generate income. The key is to differentiate between debt that builds wealth and debt that drains it.

3. “Buy a House as Soon as Possible”

Homeownership is often seen as the ultimate financial milestone, but rushing into buying a house can tie up your funds and limit your flexibility. Renting can sometimes be a smarter choice, especially if it allows you to invest in higher-return opportunities. A house can be an asset, but it’s not always the best first step to wealth.

4. “Always Follow a Budget”

Budgets are a helpful tool, but rigidly adhering to one can make you miss out on valuable opportunities. Instead, focus on a more flexible financial plan that prioritizes investments and aligns with your goals. This approach allows for adaptability and ensures you’re not just saving but also growing your wealth.

5. “Stick to One Job”

Relying solely on one source of income is a traditional rule that can limit your earning potential. Building real wealth often requires diversifying your income streams. Consider freelancing, starting a side hustle, or investing in passive income opportunities to expand your financial foundation.

6. “You Must Work Hard to Get Rich”

Hard work is important, but working smarter is what builds wealth. Investing in assets, leveraging technology, and understanding how to make your money grow while you sleep are smarter paths to financial success. Focus on efficiency, automation, and passive income rather than overextending yourself with constant hustle.

7. “Avoid Risk at All Costs”

The fear of risk often keeps people stuck in their financial comfort zones. However, calculated risks are essential for wealth building. Investments like stocks, cryptocurrencies, or starting your own business may feel uncertain, but they also have the potential for higher returns. Evaluate risks wisely and leap when it makes sense.

8. “You Need a Lot of Money to Start Investing”

This outdated rule stops many people from even beginning their wealth-building journey. In reality, you can start investing with small amounts through fractional shares, low-cost ETFs, or apps designed for beginners. Consistent, incremental investments can compound significantly over time.

9. “Only Buy Brand New”

From cars to clothes, the idea that newer is better can drain your finances. Depreciation on new items, especially vehicles, is a wealth killer. Buying pre-owned or refurbished goods allows you to save money without compromising on quality, freeing up cash to invest in appreciating assets.

10. “Wait Until You’re Older to Save for Retirement”

Waiting to save for retirement is one of the biggest financial mistakes you can make. Starting early allows you to take advantage of compound interest, which exponentially grows your savings over time. Break this rule by starting now, even if it’s with a small amount, and let time work in your favor.

11. “Keep Your Money Safe in the Bank”

While it’s important to have an emergency fund, keeping all your money in a savings account limits your financial growth. Banks offer minimal interest rates that don’t keep up with inflation. Invest your excess funds in higher-return opportunities to grow your wealth faster.

12. “Retire at 65”

The traditional retirement age is no longer a fixed rule. Building real wealth means having the freedom to choose when and how you retire. Early retirement, partial retirement, or continuing to work on passion projects are all viable options when you focus on financial independence rather than a set age.

Real wealth is built by taking calculated risks, making informed decisions, and breaking free from outdated financial conventions. By challenging these traditional money rules, you can create a more dynamic, flexible, and rewarding approach to your finances. Remember, the key to wealth isn’t just saving—it’s making your money work for you.