Ponzi schemes have been around for decades, luring in victims with promises of high returns and minimal risk. While many assume only the financially naive fall for these scams, history has shown that even celebrities, seasoned investors, and billionaires have been duped. The masterminds behind these schemes are often charismatic, convincing, and able to exploit trust and greed to fund their fraudulent operations. From Hollywood stars to financial institutions, some of the biggest names in business and entertainment have lost millions. These jaw-dropping stories prove that no one is immune to financial deception.

1. The Hollywood Ponzi Scheme That Fooled A-List Celebrities

Dana Giacchetto, a financial advisor to the stars, promised some of Hollywood’s biggest names secure, high-return investments. His clients included Leonardo DiCaprio, Matt Damon, and Ben Affleck, who trusted him to manage their wealth. Instead, he funneled their money into his accounts, funding a lavish lifestyle of private jets, exclusive parties, and expensive cars. He reassured his clients with false account statements, making it seem as though their investments were growing.

Giacchetto’s scheme unraveled in 2000 when regulators discovered he had misappropriated over $10 million. He was sentenced to 57 months in prison, leaving many of his celebrity clients financially scarred. His scam exposed how even the richest and most well-connected individuals can fall for financial fraud. Many stars became more cautious about who they trusted with their money. The lesson? Just because someone is popular in high society doesn’t mean they’re trustworthy with finances. According to the Los Angeles Times, Giacchetto pleaded guilty to investment fraud for misappropriating millions from his clients.

2. Bernie Madoff—The Biggest Ponzi Scheme in History

Bernie Madoff orchestrated the largest Ponzi scheme ever recorded, defrauding investors of nearly $65 billion. For decades, Madoff convinced clients—including celebrities, charities, and hedge funds—that he was delivering consistent, high returns. In reality, he was using new investors’ money to pay off older ones, creating an illusion of profitability. His clients, including Hollywood stars like Kevin Bacon and Steven Spielberg, had no idea they were part of one of the most elaborate financial scams in history.

Madoff’s empire collapsed in 2008 when the financial crisis led to a surge in withdrawal requests that he couldn’t fulfill. He was arrested and sentenced to 150 years in prison, but the damage had already been done. Many victims lost their life savings, while charities and institutions were left bankrupt. The sheer scale of his deception shocked the world and led to tighter financial regulations. His story remains a cautionary tale about the dangers of trusting financial advisors blindly. According to Investopedia, Madoff’s scheme involved creating an illusion of profitability while using new investors’ money to pay returns to earlier investors.

3. The Billionaire Banker Who Wasn’t—Allen Stanford’s $7 Billion Scam

Allen Stanford posed as a successful billionaire banker, running Stanford Financial Group and promising investors high returns on “safe” certificates of deposit. With lavish offices, private jets, and sponsorship deals with elite sporting events, he appeared to be a financial genius. However, his entire empire was built on lies, with investor funds being used to sustain his extravagant lifestyle rather than legitimate investments.

His scheme unraveled in 2009 when regulators investigated his operations and found that his wealth was entirely fake. He was convicted of running a $7 billion Ponzi scheme and sentenced to 110 years in prison. Thousands of investors, including retirees and business owners, were left financially ruined. His fraud remains one of the most significant in history, proving that even those who appear wealthy and successful can be fraudsters. The illusion of luxury often masks financial deception. According to Wikipedia, Stanford’s fraudulent activities included selling unregistered securities and misappropriating investor funds.

4. The “King of Clubs” Who Stole Millions

John Bravata was known for throwing extravagant parties at nightclubs while running his investment firm, BBC Equities. He convinced investors—many of them retirees—to put their savings into his real estate ventures, promising double-digit returns. Instead of investing the funds, he spent them on luxury homes, cars, and wild parties. His clients believed they were part of a successful enterprise, but in reality, their money was being used to fund his lavish lifestyle.

Bravata’s $50 million scheme collapsed in 2009 when the SEC shut down his operations. Many of his victims lost everything, including their retirement savings. He was sentenced to 20 years in prison, but for many of his investors, the damage was irreversible. His case highlighted how Ponzi schemes often prey on trust and greed. The more extravagant the lifestyle, the more skeptical investors should be. According to the FBI, Bravata’s fraudulent activities involved misappropriating investor funds for personal use rather than legitimate investments.

5. The Church Ponzi Scheme That Stole from the Faithful

Ephren Taylor marketed himself as a Christian financial guru, offering investment opportunities that promised both profit and purpose. He targeted religious communities, convincing churchgoers to invest in projects that aligned with their faith. Many trusted him because he spoke at mega-churches and received endorsements from well-known pastors. However, his investments were a sham, and he was secretly using investor money to fund his expenses.

Taylor scammed over $16 million from church members before his scheme collapsed in 2012. Many victims were left financially devastated, having trusted him with their life savings. He was sentenced to nearly 20 years in prison, but for those who lost everything, the betrayal cut deeper than just financial loss. His case serves as a stark reminder that scammers often exploit trust, especially within tight-knit communities. Even religious affiliations don’t make someone immune to fraud.

6. The “Crypto Genius” Who Was a Fraud

Gerald Cotten, the founder of QuadrigaCX, was once seen as a pioneer in cryptocurrency investment. He convinced thousands of investors that his platform was the safest way to trade and store Bitcoin. However, after his unexpected death in 2018, investors realized their money had vanished. Cotten had secretly been running a Ponzi scheme, using new investor funds to cover withdrawals while hiding millions in personal accounts.

Authorities discovered that QuadrigaCX had no real reserves and that Cotten had spent investor money on luxury travel and personal indulgences. Over $250 million in customer funds went missing, making it one of the biggest cryptocurrency frauds in history. Many believe Cotten faked his death to escape legal consequences. His scheme revealed the risks of trusting unregulated crypto platforms. Even in the digital age, classic Ponzi tactics remain a significant threat.

7. The Wine Ponzi Scheme That Fooled Collectors

Rudy Kurniawan was a wine connoisseur who became famous for selling rare, vintage wines to collectors and investors. He claimed to have access to exclusive bottles worth hundreds of thousands of dollars. Wealthy clients—including Hollywood elites—flocked to buy from him, believing they were acquiring some of the world’s most valuable wines. However, Kurniawan was refilling cheap bottles with fake labels and selling them as luxury wines.

His fraud unraveled in 2012 when experts tested his bottles and found them to be faked. He had scammed collectors out of millions, and many of his buyers were too embarrassed to admit they had been duped. He was sentenced to 10 years in prison, and his case became one of the most infamous frauds in the fine wine industry. His scheme proved that even the wealthiest investors could fall for a well-executed scam. The lesson? Always verify before investing, no matter how prestigious the seller appears.

8. The Socialite Who Scammed New York’s Elite

Anna Sorokin, better known as Anna Delvey, posed as a wealthy German heiress while living a lavish lifestyle in New York City. She convinced high-profile individuals, luxury hotels, and banks that she had a massive fortune overseas and was working on launching an exclusive social club. Using charm and connections, she secured loans, free stays at five-star hotels, and private jet trips—all without ever paying. Her scam unraveled when banks and friends started asking for their money back, only to realize she had nothing to repay them with.

In 2019, Sorokin was convicted of grand larceny and sentenced to prison for defrauding businesses and acquaintances out of over $275,000. Her story became infamous because of how easily she fooled the city’s wealthiest and most influential people. The case highlighted how scammers don’t always rely on traditional investment fraud but can manipulate social circles for financial gain. Many of her victims, embarrassed by their gullibility, chose not to come forward. The illusion of wealth can often be just as effective as actual financial backing when it comes to deception.

9. The MLM That Robbed Thousands—Herbalife’s Pyramid Allegations

Herbalife, a well-known nutrition and supplement company, has faced accusations for decades of operating like a pyramid scheme rather than a legitimate business. While it promises distributors financial independence, the majority end up losing money after investing in large amounts of inventory. The company thrives on recruitment, with the highest earners making money off recruits rather than actual product sales. Investigations revealed that only a tiny fraction of participants made a profit, while most suffered financial losses.

In 2016, Herbalife settled with the Federal Trade Commission (FTC) for $200 million after being accused of misleading recruits. Though it avoided being officially classified as a Ponzi scheme, the structure of its earnings still resembles one. Many former distributors, lured in by promises of financial freedom, found themselves in massive debt instead. While Herbalife still operates today, the case serves as a warning against multi-level marketing (MLM) companies that prey on financial desperation. If a business relies more on recruitment than actual sales, it’s a red flag.

10. The “Wolf of Wall Street” Scam

Jordan Belfort, the infamous “Wolf of Wall Street,” ran a fraudulent stock brokerage firm called Stratton Oakmont in the 1990s. Using aggressive sales tactics, his firm manipulated stock prices through pump-and-dump schemes, tricking investors into buying worthless stocks. He and his associates made millions while their victims lost everything. Belfort’s lavish lifestyle—complete with yachts, private jets, and wild parties—was entirely funded by stolen investor money.

His empire collapsed in 1999 when he was arrested and sentenced to prison for securities fraud and money laundering. He was ordered to repay over $110 million to defrauded investors, though many never saw their money again. His story was later made famous in The Wolf of Wall Street, starring Leonardo DiCaprio. While Belfort now works as a motivational speaker, his past serves as a reminder of the dangers of financial scams. His case exposed the greed and corruption that can thrive in the financial industry.

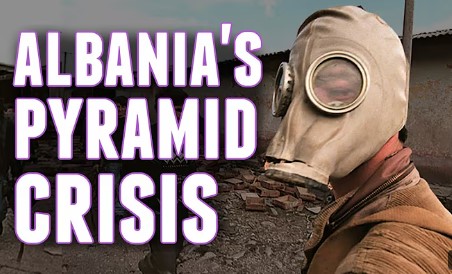

11. The Ponzi Scheme That Took Down a Country—Albania’s Economic Collapse

In the 1990s, Albania was devastated by a series of government-backed Ponzi schemes that tricked nearly two-thirds of the country’s population. Citizens were promised high returns on their investments, and as more people joined, the schemes kept growing. The government even encouraged people to invest, creating a false sense of security. However, when the schemes inevitably collapsed in 1997, thousands of people lost their entire life savings, leading to widespread riots and economic instability.

The financial collapse triggered nationwide protests and violent clashes that resulted in hundreds of deaths. The Albanian government fell, and the country plunged into chaos, with many blaming political corruption for allowing the fraud to continue. The scale of this Ponzi scheme was so massive that it effectively crippled Albania’s economy for years. It remains one of the most extreme examples of how financial fraud can impact an entire nation. The lesson? When something sounds too good to be true, it probably is—no matter how many people believe in it.

12. The Woman Who Scammed Her Clients—Doris Payne

Doris Payne isn’t a traditional Ponzi schemer, but her decades-long career as a con artist makes her one of the most fascinating fraudsters in history. A skilled jewel thief, Payne posed as a wealthy socialite to gain the trust of high-end jewelers. She would charm store owners into letting her try on expensive jewelry, then discreetly pocket the most valuable pieces. Her scams spanned over 60 years, taking place in multiple countries and netting her millions.

Despite being arrested multiple times, Payne always found a way to talk her way out of trouble or disappear before authorities could catch her. Even in her 80s, she continued stealing from luxury jewelry stores, claiming it was an addiction rather than a crime. Her story was so unbelievable that it became the subject of a documentary titled The Life and Crimes of Doris Payne. While her scams weren’t Ponzi schemes in the traditional sense, they highlight how deception and manipulation can take many forms. Trusting appearances can sometimes be a costly mistake.

13. The Fake Royalty Who Fooled European Elites

Anthony Gignac spent decades pretending to be a Saudi prince, using his fake royal identity to scam millions from investors and luxury hotels. By dressing in designer clothing, driving expensive cars, and carrying diplomatic passports, he convinced people he was part of the Saudi royal family. Wealthy businesspeople eagerly invested in his “exclusive” deals, believing they were gaining access to rare opportunities. However, his entire persona was a lie, and none of his investments existed.

His scheme fell apart in 2017 when a real Middle Eastern investor became suspicious of Gignac’s eating habits—he openly consumed pork, which is forbidden in Islam. After an investigation, authorities discovered his fraud and arrested him. He was sentenced to 18 years in prison for scamming over $8 million from his victims. His case showed how scammers often rely on appearances and prestige rather than actual financial credentials. Even the most sophisticated investors can be fooled when they prioritize status over due diligence.

These shocking Ponzi schemes and financial frauds prove that no one is immune to deception. Whether it’s celebrities, billionaires, or entire governments, scammers have a way of exploiting trust, greed, and appearances. While financial regulations have improved, new scams continue to emerge, often disguised as cutting-edge investments like cryptocurrency or social media-driven schemes. The lesson? Always verify before you invest, question promises of guaranteed returns, and never assume wealth or status equals credibility. The more elaborate the fraud, the harder it is to spot—but history has shown that all scams eventually collapse, leaving devastation in their wake.