While everyday people struggle to afford rent, the ultra-wealthy have the power to buy entire neighborhoods with ease. Rising housing costs, corporate real estate investments, and exclusive financial loopholes allow the rich to dominate property markets while middle- and lower-income families are priced out. Luxury developments, tax breaks, and insider deals make it easier for the wealthy to accumulate real estate, turning entire communities into playgrounds for the elite. Meanwhile, skyrocketing rents and stagnant wages leave many unable to afford even a modest home. Here’s how the rich are quietly buying up entire neighborhoods while the average person fights to keep a roof over their head.

1. They Use Shell Companies to Hide Purchases

Rich investors and corporations often buy up real estate through shell companies, hiding their ownership from public records. This makes it difficult for local governments and communities to track who controls housing in their neighborhoods. By operating through anonymous LLCs, the wealthy can accumulate massive amounts of real estate without drawing attention. This strategy also helps them avoid regulations and taxes that individual buyers would normally face.

When ownership is hidden, communities lose their ability to challenge unfair property practices. Many tenants don’t even know who their landlords are, making it harder to demand repairs or negotiate fair rent prices. Real estate speculation thrives under this system, allowing the rich to quietly take over entire areas. Meanwhile, ordinary homebuyers struggle with mortgage approvals, credit checks, and rising interest rates. The housing market is designed to favor those who can afford to play the system. According to The Washington Post, shell companies significantly impact transparency in real estate ownership.

2. They Buy Homes in Bulk for Investment

Unlike the average homebuyer, the wealthy don’t purchase just one property—they buy entire streets, blocks, or even entire neighborhoods. Large-scale real estate investors often purchase multiple homes at once, outbidding regular buyers. This strategy allows them to control property values and dictate rental prices. Once they own a significant portion of an area, they can transform it into an exclusive, high-priced community. The result? Residents are priced out, and affordable housing becomes scarce.

Corporate landlords and private investors capitalize on this trend, using massive capital to acquire properties before regular buyers can even compete. With cash offers and no financing delays, they close deals quickly, making it nearly impossible for average people to secure homes. Many cities are now dominated by real estate firms rather than individual homeowners. When entire neighborhoods are bought for profit instead of residency, housing affordability disappears. The rich don’t just buy homes—they buy control over the market. According to Psychreg, bulk property investing allows investors to acquire multiple properties simultaneously, impacting local housing markets significantly.

3. They Exploit Luxury Developments to Drive Up Prices

The wealthy invest in luxury developments that reshape entire communities, driving property values far beyond what locals can afford. When high-end condos, gated communities, and exclusive apartment buildings are introduced, they push surrounding prices higher. As a result, middle- and lower-income residents are forced out, unable to keep up with rising rents and property taxes. This cycle of gentrification benefits investors while displacing longtime residents.

These luxury developments aren’t built to house everyday people—they cater to wealthy buyers who want exclusivity. Developers prioritize profit over community stability, turning neighborhoods into upscale districts that only the rich can afford. Meanwhile, essential workers and longtime residents are left with fewer housing options. The more luxury buildings that appear, the harder it becomes for regular people to find affordable places to live. The wealthy don’t just move in—they transform entire neighborhoods to serve their interests. This phenomenon is discussed in detail by Bankrate as it highlights how investors drive up property prices through luxury developments.

4. They Take Advantage of Tax Breaks and Loopholes

The rich benefit from tax breaks that ordinary people can’t access, making it easier for them to buy and hold real estate. Programs like the 1031 exchange allow investors to defer taxes when they sell properties and reinvest the profits. Additionally, tax deductions on mortgage interest and depreciation give landlords financial advantages that renters don’t have. These loopholes enable the wealthy to grow their property empires while middle-class families struggle to save for a down payment.

Meanwhile, rising property taxes make homeownership even more difficult for regular buyers. When investors drive up real estate prices, local taxes increase, pushing more people into renting instead of buying. The government’s tax policies favor those who already own property, widening the wealth gap between landlords and tenants. While the rich accumulate assets and pay fewer taxes, working-class renters see their housing costs rise without relief. The system ensures that real estate remains in the hands of the few, not the many. This issue is further explored in SmartAsset as it discusses various tax benefits available specifically to real estate investors that contribute to these disparities.

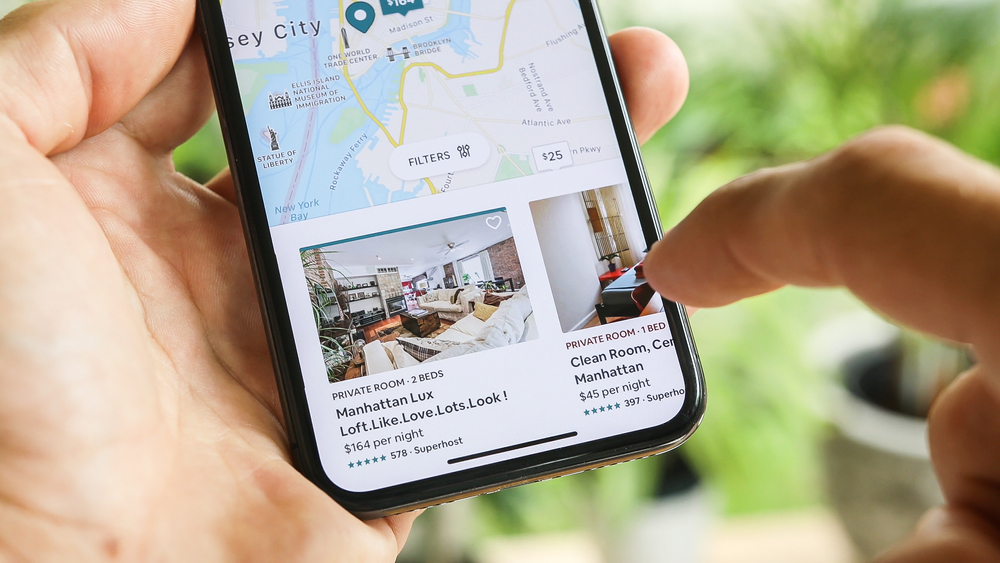

5. They Profit from Short-Term Rentals Like Airbnb

Wealthy investors turn residential homes into short-term rentals, removing them from the long-term housing market. Platforms like Airbnb and Vrbo allow property owners to charge premium prices for nightly stays, making it more profitable than traditional renting. As a result, entire neighborhoods are converted into vacation rentals instead of homes for residents. This reduces the number of available rentals, driving up prices for those who need a place to live.

The shift toward short-term rentals makes it nearly impossible for low- and middle-income earners to find affordable housing. Investors prioritize tourists and short-term guests over long-term tenants, increasing housing instability. Many cities have attempted to regulate short-term rentals, but enforcement remains weak. Wealthy property owners continue to profit, while local communities bear the burden of rising rents and fewer housing options. The rich have turned homes into hotels, leaving residents scrambling for a place to live.

6. They Influence Zoning Laws to Benefit Their Investments

Wealthy developers and investors use their influence to shape zoning laws, ensuring that new developments benefit them. By lobbying city officials, they push for rezoning that allows luxury housing while restricting affordable options. This prevents working-class families from buying homes in desirable areas and increases housing inequality. Zoning laws that could encourage affordable housing are often blocked or ignored in favor of high-profit developments.

Meanwhile, communities that need more housing options are left with limited choices. When zoning regulations favor the wealthy, it becomes harder for regular people to secure stable housing. The rich manipulate urban planning to maximize their profits, disregarding the needs of residents. This creates neighborhoods designed for the elite, where only the wealthy can afford to live comfortably. The housing crisis isn’t accidental—it’s the result of policies shaped by those who profit from it.

7. They Buy Distressed Properties and Flip Them for Profit

Rich investors target foreclosed or distressed properties, buying them at low prices and reselling them for massive profits. This drives up home values, making it even harder for first-time buyers to enter the market. While the wealthy see these purchases as opportunities, struggling homeowners lose their chance at ownership. The practice of house flipping turns housing into a business rather than a necessity.

Flipping properties may seem harmless, but it worsens the affordability crisis. Investors buy cheap homes, renovate them, and sell them at inflated prices that everyday buyers can’t afford. This cycle creates a market where only those with significant capital can compete. First-time homebuyers are forced to either rent indefinitely or take on extreme debt. The rich turn struggling communities into investment opportunities, further deepening financial inequality.

8. They Secure Low-Interest Loans That Aren’t Available to You

Wealthy investors have access to financing options that ordinary buyers could never dream of. They qualify for low-interest loans, large credit lines, and special financing deals that allow them to buy multiple properties at once. While everyday buyers struggle with mortgage approvals and high interest rates, the rich enjoy financial perks that make real estate investment easy. These exclusive lending opportunities give them an unfair advantage in the housing market.

Banks prioritize high-net-worth individuals, offering them better loan terms and faster approval processes. This allows the wealthy to outbid regular buyers, snapping up properties before others can even secure financing. The average homebuyer is left dealing with strict lending requirements and increasing borrowing costs. The financial system ensures that property ownership remains in the hands of those who already have wealth. For the rich, real estate is a game they are set up to win.

9. They Buy Properties Before They Even Hit the Market

One of the biggest advantages the wealthy have in real estate is their ability to purchase properties before they even become available to the public. Known as “off-market deals” or “pocket listings,” these transactions happen privately between sellers and wealthy buyers, bypassing the traditional home-buying process. Real estate agents and developers often prioritize selling to high-net-worth individuals because they can pay in cash, close deals quickly, and avoid complications like mortgage approvals. This means that by the time regular buyers see a listing, the best properties have already been sold.

These exclusive deals make it nearly impossible for middle-class families to compete for homes in desirable neighborhoods. Regular buyers must rely on public listings, where bidding wars drive up prices and investors swoop in with cash offers. Meanwhile, the rich secure prime real estate through connections and private negotiations, ensuring they always have the best opportunities. By controlling access to the most valuable properties, the wealthy maintain dominance in the real estate market. Ordinary buyers are left with limited and overpriced options, making homeownership feel increasingly out of reach.

10. They Invest in Exclusive, Members-Only Communities

The wealthy don’t just buy homes—they invest in entire communities designed to keep others out. Gated neighborhoods, private islands, and members-only housing developments offer exclusive living spaces that cater only to the ultra-rich. These communities often have strict entry requirements, high membership fees, and luxury amenities that regular buyers could never afford. Many of these private developments include their security, schools, golf courses, and even private beaches, ensuring that residents never have to interact with the general public.

While these communities provide luxury and privacy for the wealthy, they also deepen housing inequality. They take up valuable land that could be used for more inclusive housing developments, limiting options for middle-class and working-class families. Additionally, these private enclaves often influence local policies, pushing for zoning laws that restrict affordable housing nearby. This creates a divide where only the elite can access the best locations, services, and infrastructure while regular citizens struggle with rising living costs. The rich don’t just buy homes—they create entire worlds where only they are welcome, leaving the rest of society behind.

The wealthy don’t just buy homes—they buy power, influence, and entire neighborhoods while everyday people struggle with rising rents. Through bulk purchases, tax breaks, zoning laws, and exclusive financing, they manipulate the real estate market in their favor. Housing is no longer about providing shelter—it’s about generating wealth for those who already have it. If policies don’t change to limit real estate monopolization, homeownership will remain a privilege for the elite while renters face an endless cycle of rising costs.